COVID-19 Relief Bill Includes 4% Housing Credit Floor Rate

The COVID-19 pandemic has highlighted the desperate need for more affordable housing more than ever before. This includes rising costs of construction, limited resources and a pandemic that has caused businesses to shut down or limit capacity. The affordable housing industry caught a break when President Biden signed the Consolidated Appropriations Act, 2021 on December 27, 2020, which included a provision to permanently fix the applicable percentage for tax exempt bond financed projects and acquisition projects to a minimum of 4% (4% floor).

The 4% floor applies to:

- Certain acquired existing building tax credit projects.

- Tax-exempt bond financed tax credit projects.

The 4% floor is effective for:

- Any building that receives an allocation of housing credit dollar amount after December 31, 2020, and is placed in service after December 31, 2020.

- Any building, any portion of which is financed with tax exempt bond financing that was issued after December 31, 2020 and is placed in service after December 31, 2020.

The 4% floor will provide affordable housing projects with:

- Additional equity to finance development costs.

- A reduced need for soft funds from nonprofits, local and state governments to finance development costs.

- An increased investor’s capital account which in turn may reduce exit taxes if or when the investor exits.

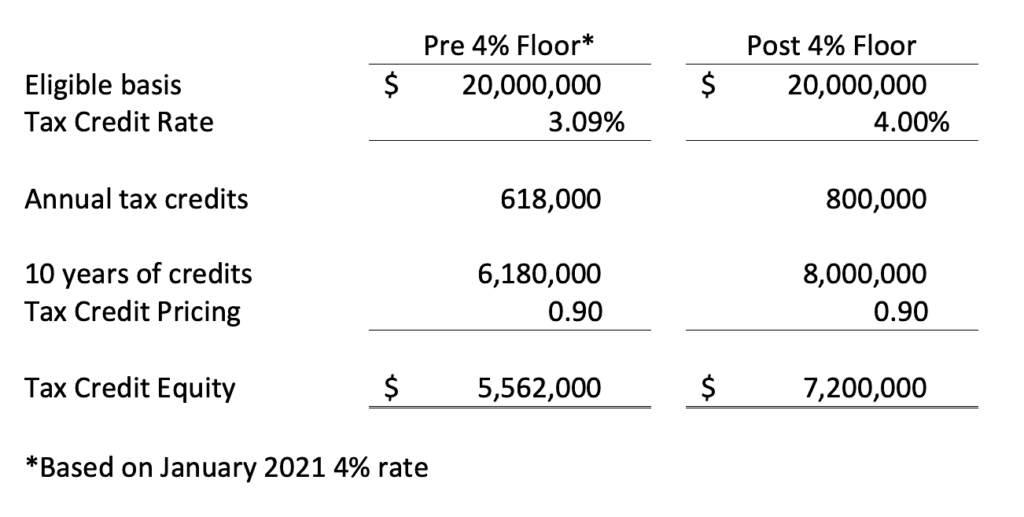

Every project is different and negotiated under different terms, however, let’s look at the following scenarios before and after the 4% floor:

In this scenario the project generates $1,820,000 of additional tax credits over 10 years with the 4% floor, which would result in $1,638,000 of additional equity to finance the project.

There are many things to consider when reviewing your project and whether the 4% floor will apply to it. Things to consider are:

- There are certain scenarios that may require further guidance from Congress or the IRS to determine if the 4% floor will apply to a project (draw down bonds originally issued in 2020, and additional bond issuance in 2021).

- IRS Code Section 42 specifically precludes a project from being allocated more tax credits than what is needed. If a project was negotiated prior to the 4% floor with a lower rate, and all other financing is in place, conceivably additional tax credits may not be needed.

- The 4% floor will provide more tax credits for a project, but it may affect the pricing an investor is willing to pay for the tax credits as well. It will not necessarily be a 1:1 increase in equity.

For additional considerations please reach out to Tom Johnson, CPA or contact our Real Estate Solutions Team at Mahoney.

View our real estate FAQs resource page