S-Corporations: Shareholder Basis & Pass-Through Loss Limitations

S-corporations are considered pass-through entities, which means that income and losses earned from the business are passed down to the individual shareholders’ tax returns. However, an S-corporation shareholder cannot automatically assume that a loss passed through from the company is deductible on his or her individual income tax return. This is where the importance of keeping track of shareholder basis comes into play. For an S-corporation shareholder to deduct a loss on his or her individual return, the shareholder must clear a few hurdles. Understanding what affects shareholder basis and knowing the tax implications of the major pass-through loss limitations is critical for every business owner.

Shareholder Basis in S-Corporation Stock

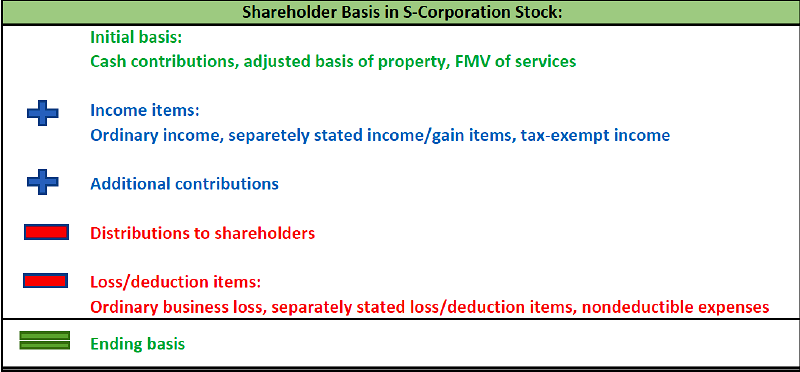

When computing a shareholder’s basis in his or her stock, their initial capital contribution to the S-corporation will be the first item that increases stock basis. This will be a cash contribution, the adjusted basis of any property contributed, or the fair market value of any services rendered. This initial amount is then increased and/or decreased based on the pass-through amounts from the company. A shareholder’s stock is increased by ordinary income, separately stated income items, tax-exempt income, and any additional capital contributions made by the shareholder. A shareholder’s stock basis is then decreased, but not below zero, by ordinary losses, separately stated loss items, nondeductible expenses, and any distributions.

Below is a diagram that summarizes the items that affect S-corporation stock basis:

Tax Planning & Consequences of Distributions

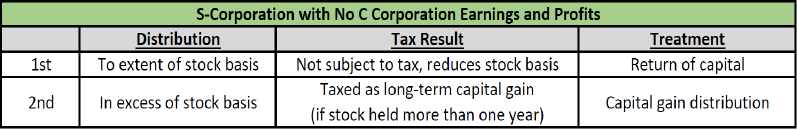

Distributions to the shareholder are not included in the shareholder’s gross income if the distribution does not exceed the shareholder’s basis in the S-corporation stock. The non-taxable distributions are treated as a return of capital and reduce the shareholder’s stock basis. If the amount of the distribution exceeds the shareholder’s basis, the excess is taxed to the shareholder as a capital gain.

If the business has been an S-corporation for its entire existence and has no prior C corporation earnings and profits, the below diagram summarizes the rules for determining the taxability of distributions:

Basis Ordering Rules

Since the taxability of a distribution and the deductibility of a loss are dependent on stock basis, the order in which stock basis is increased or decreased is an important aspect of shareholder basis. Stock basis is adjusted on the last day of the S-corporation year in the following order:

-

- Increased for income items

- Decreased for distributions

- Decreased for non-deductible expenses

- Decreased for deductible expenses and loss items

Tax Basis Limitation

Tax basis is an important test to determine whether the shareholder can deduct a loss from the company on his or her individual tax return. This includes the shareholder’s stock basis from the diagram above and any direct loans made from the shareholder to the S-corporation. A loss in excess of the shareholder’s tax basis is suspended until tax basis is reinstated in future years. Any increases in tax basis in future years will reinstate the debt basis first, then the stock basis. A suspended loss due to insufficient tax basis can be carried forward indefinitely. However, any suspended losses due to insufficient tax basis remaining when the shareholder disposes of his or her stock are lost. For additional tax planning and business tax considerations, please reach out to Travis Koester, Associate, or contact our Tax Solutions team at Mahoney to be of help to you in any way.

Additional Reading: S Corp Owners Should Plan Their W-2 Wages